Discover the top 10 options strategies expert traders use to maximize profits and manage risk. Learn about covered calls, iron condors, and more in this easy-to-understand guide to options strategies.

Introduction

Options trading is an exciting way to invest, but it can be risky without the right approach. Expert traders often rely on advanced strategies to help balance risk and reward. In this article, we’ll explore 10 of the most popular options strategies that experienced traders use to stay ahead.

What Are Options?

In simple terms, options are contracts that give you the right, but not the obligation, to buy (call) or sell (put) a stock at a set price within a specific timeframe. They’re often used for speculation or to protect existing investments.

Call and Put Options

- A call option lets you buy a stock at a fixed price before the contract expires.

- A put option gives you the right to sell a stock at a specific price before the contract ends.

You may also like: Top 10 Hidden Dangers of Gold as an Investment You Should Know

Why Use Options Strategies?

Traders use options for several reasons:

- Risk Management: Options allow traders to hedge their bets and protect against market downturns.

- Leverage: With a small amount of money, you can control a larger position in the stock.

- Income: Selling options can provide a steady income stream.

Balancing Risk and Reward

In options trading, there’s always a risk of losing money, but certain strategies can help limit those losses while offering the potential for profit.

Top 10 Options Strategies

Let’s take a look at the most common options strategies used by expert traders:

1. Covered Call

A covered call is when you own a stock and sell a call option on it. You keep the premium from the option, and if the stock doesn’t rise too much, you also get to keep your shares.

2. Protective Put

A protective put is like insurance for your stock. If the stock’s price drops, the put option protects you by allowing you to sell it at a higher price, limiting your loss.

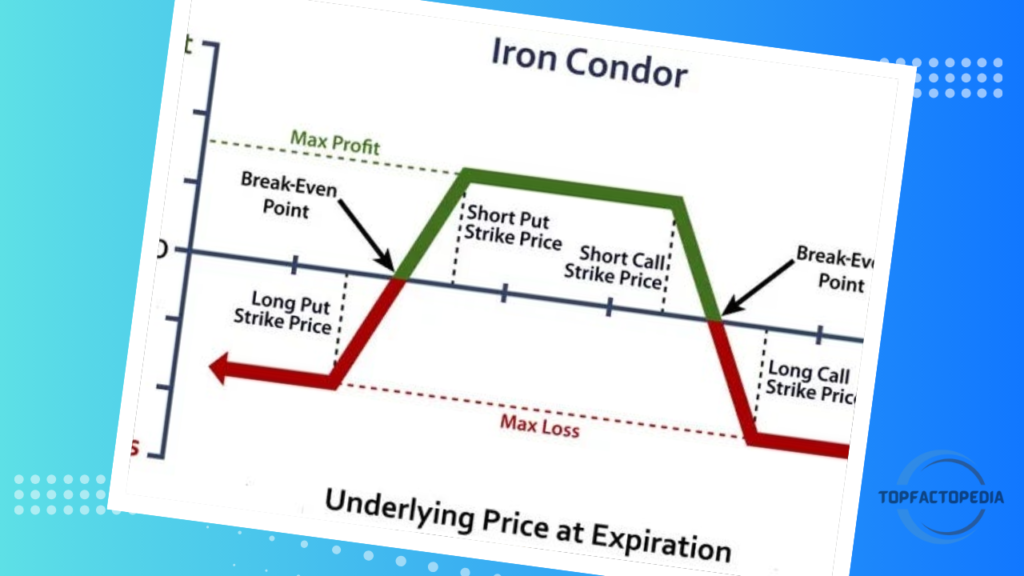

3. Iron Condor

An iron condor is a neutral strategy that works best when a stock doesn’t move much. You use four options at different strike prices to create a range where you can make a profit if the stock stays within that range.

4. Straddle

A straddle is for traders who expect big price swings but aren’t sure of the direction. It involves buying both a call and a put option at the same strike price. No matter which way the price moves, one side of the trade will profit.

5. Butterfly Spread

A butterfly spread is used in low-volatility environments. It combines both calls and puts to create a strategy that profits from small price movements while limiting risk.

6. Bull Call Spread

A bull call spread is used when you expect the stock to rise. You buy a call option and sell another call at a higher strike price. This limits your gains but reduces the cost of the trade.

7. Bear Put Spread

A bear put spread is the opposite of a bull call spread. You buy a put option and sell another put at a lower strike price to make money when the stock falls, while also lowering the cost of the trade.

8. Calendar Spread

A calendar spread takes advantage of time decay. You sell a short-term option and buy a longer-term one at the same strike price. This strategy works best when you expect the stock to stay stable in the short term but might move later.

9. Collar Strategy

A collar strategy is a way to protect a stock you already own. You buy a put option to protect against a drop in price and sell a call option to generate some income, limiting both your upside and downside.

10. Diagonal Spread

A diagonal spread is similar to a calendar spread but uses different strike prices. This strategy allows you to benefit from changes in volatility while also taking advantage of time decay.

You may also like: Top 10 Hidden Threats to Financial Risk Control You Need to Know

How to Choose the Right Strategy

The best strategy for you depends on two main factors:

- Market Conditions: Is the market volatile, or is it stable? Different strategies work better in different environments.

- Risk Tolerance: How much are you willing to lose? Some strategies limit your risk, while others offer higher rewards but with greater risk.

Tools for Options Trading

If you’re serious about options trading, you’ll need the right tools. Look for platforms that provide real-time data, volatility analysis, and easy-to-use trading interfaces. These tools will help you stay ahead of market trends and make smarter trades.

Real-Life Examples of Successful Traders

Some of the world’s top traders have built their fortunes using options strategies. For example, George Soros famously used options in currency trading, while Bill Ackman often uses options to hedge his positions in large companies.

Conclusion

Options trading can be a great way to grow your investments, but it requires careful planning and strategy. By using these 10 options strategies, you can maximize your returns while minimizing risk. Whether you’re just starting out or are an experienced trader, these strategies will help you navigate the exciting world of options trading.

Few More Queries

1. What’s the safest options strategy?

The covered call strategy is one of the safest because it generates income while you still own the stock.

2. Can I lose all my money in options trading?

Yes, options trading carries the risk of losing your entire investment if you’re not careful. That’s why using the right strategies is important.

3. Which strategy is best for beginners?

A bull call spread or covered call is a good place to start because they limit risk while offering the potential for profit.

4. Can I make money in a flat market with options?

Yes, strategies like the iron condor and butterfly spread work well when the stock isn’t moving much.

5. How do I learn more about options trading?

Start with educational resources like books and online courses, and consider using demo accounts to practice before trading with real money.